September 2023

Royal Unibrew – a refreshing success story

The Danish drinks manufacturer has sort of a chequered history. After almost going bankrupt in 2008, the company was able to recover successfully and generate attractive returns for shareholders thanks to a convincing reorganisation. In the crisis year 2022, Royal Unibrew succeeded in dealing with its historical legacy on the one hand and in solving operational challenges on the other.

The history of the ‘Faxe’ beer manufacturer started in 1881

Royal Unibrew is a Danish beverage producer whose history dates back to 1881, when the company was founded in Faxe, a small town, south of Copenhagen. Since then, the company has developed into a leading player in the Scandinavian beverage market. The company is also recognised internationally: In Germany, Faxe beer is sold in 1-litre cans (exclusively at petrol stations) and in Italy, Royal Unibrew’s premium beer brand” Ceres” seems well established.

Product portfolio: Focus on non-alcoholic beverages

The company's product portfolio includes a wide range of alcoholic and non-alcoholic beverages such as beer, juices, soft drinks, energy drinks and water. Despite the name, beer only accounts for around 31% of sales, with the remaining 69% coming mainly from non-alcoholic beverages. The products are marketed under various well-known local brands such as Royal, Faxe, Faxe Kondi and Albani.

In its core markets, Royal Unibrew is not only active as a brewer and bottler of its own brands, but also as a licensed brewer and distributor for companies such as PepsiCo and Heineken. The company's distribution channels include both retail and catering, serving a wide range of customers such as supermarkets, convenience stores, bars, restaurants and hotels.

Survival and rise: The 2008 crisis and the subsequent transformation

The history of Royal Unibrew was characterized by some challenges. In 2008, the company found itself in a serious crisis. International expansion plans to the Caribbean and Poland failed and the financial crisis brought the company to the brink of insolvency. A capital increase and a strategic reorganisation of the company resulted into a turnaround. Investors who bought Royal Unibrew shares during the emergency capital increase were able to realise a 100-fold profit between 2009 and the end of 2021.

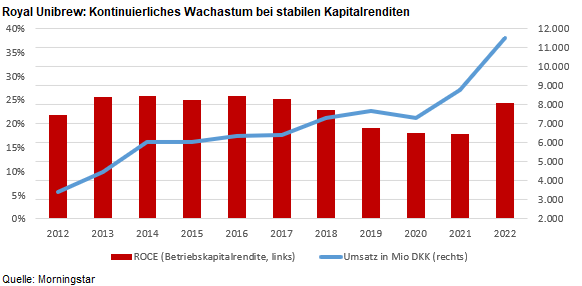

Since this critical phase, Royal Unibrew has managed to increase sales and profits at an impressive rate. In the ten years before the war in Ukraine, the company was able to increase its free cash flow per share by an average of 17% per year. Only 2022 put a damper on the business. The company’s success since 2009 was achieved through a combination of sales growth of around 13 % per year and a drastic improvement in the operating profit margin, which almost tripled from around 7 % before the financial crisis to 19 % in the successful year 2021. The return on capital employed also rose from around 8% to around 22% during this period, meaning that added value above the cost of capital is generated on a sustainable basis. The same applies to the ratio of free cash flow to capital employed.

Transformation of the business model as the key element for success

Strategic decisions such as acquisitions and the transformation of the business model played a key role in this success story: Royal Unibrew no longer operated solely as a brewery or manufacturer, but also took over distribution for licensors in the beverage sector. This enabled better control over sales outlets and prices. The company now also distributes other brands, particularly Pepsi, in some of its markets.

Innovative growth in a niche of the highly competitive beverage industry

The beverage industry is highly competitive and involves a wide range of players, from small local producers to large multinationals. The industry is evolving very dynamically and is influenced by a number of factors, such as changing consumer preferences and demographic trends. The success of the industry depends on the ability of companies to stay ahead of these trends and offer innovative products that meet changing consumer demands while balancing sustainability and profitability.

Notoriously weak beer sales as a challenge

Sales of mainstream beers are stagnating or falling worldwide, while interest in premium and craft beers is increasing. However, the real growth is taking place in the non-alcoholic beverage sector, i.e. energy drinks, carbonated soft drinks, juices and bottled teas and coffees. Royal Unibrew's strong growth can be explained by the company's forward-looking adaptation to these trends, including its own energy drink Faxe Kondi Booster.

Management performed well in the crisis year 2022

We were impressed by the quality of Royal Unibrew's management. In the crisis year 2022, the company succeeded in dealing prudently with rising wages and the distortions in the relevant commodity markets (aluminium, wheat, hops, glass bottles, electricity) as a result of the war in Ukraine. Strategically, further measures to reduce energy intensity and decarbonisation were stepped up as an immediate response to the cost burden. The increased costs were largely passed on in the form of higher prices; Royal Unibrew claims that it could even have increased prices more than its competitor Carlsberg in 2022.

Clear capital allocation targets

Even though Royal Unibrew does not have a dominant owner in its shareholder structure, the incentives for management are well aligned. On the capital allocation side, the clear objectives regarding dividend policy, share buybacks and the structured process for acquisitions are convincing. The corporate structure is also decentralised and managed from a very lean head office in Faxe and requests from investors are answered diligently and swiftly.

Convincing corporate culture

In terms of its corporate culture, Royal Unibrew demonstrates sensitivity in dealing with its historical heritage as a former state brewery on the one hand and the emergence into the digital ‘influencer’ life with hip mixed drinks and energy drinks on the other.

Author: Christian Kahler

The contents of this page are marketing communications and not financial analyses. It does not constitute investment advice or an investment recommendation, nor does it constitute an offer or a recommendation or invitation to make an offer to buy or sell the financial products mentioned. Insofar as we have presented performance and/or sample calculations in the aforementioned information, these do not allow any reliable conclusions to be drawn about future performance. References to past performance do not necessarily guarantee positive developments in the future, and reference is also made to the risk associated with transactions in financial products. The information mentioned reflects the author's judgement at the time of publication. The company discussed may or may not be part of the portfolio of our equity fund. Any investment decision should always be based on an individual analysis of the personal financial situation and risk tolerance.