May 2024

Atlas Copco's recipe for success: innovation and scalability

We consider the Swedish industrial company Atlas Copco to be one of the best-managed companies in the world. Over the past 20 years, investors have realised a return of over 20% per year, or 4,000% in total. This success is based on the focussed and scalable business model.

Today, Atlas Copco concentrates on four areas: Compressor technology for compressing gases for industrial processes, vacuum technology for packaging and clean rooms, industrial applications and energy technology. With 53,000 employees in 71 countries, the company recently achieved an annual turnover of 15 billion euros.

Compressor technology is required in the production process to compress gases, i.e. to increase the pressure. Compressed air is used to power tools and machines, clean materials, control industrial processes, process food and beverages or operate medical devices such as inhalers.

The generation of a vacuum plays an important role in industrial manufacturing, in the packaging industry, but also in production in dust-free clean rooms, which are used in the production of semiconductors and solar cells, as well as in paint shops. Vacuum devices in turn need to be cooled, so Atlas Copco can supplement its product range with corresponding products from the compressor and energy technology sectors.

Atlas Copco serves customers in the industrial, chemical, food, construction and public sectors. The increasing demand for low-CO2 and efficient production solutions is driving demand for the company's continuously developed products.

The company operates a very focused and scalable organisation with products that are largely resistant to recession. The company generated profits even in the crisis year of 2008.

This resilience is made possible by the low capital intensity and the focus on customer service. Whenever business prospects deteriorate, Atlas Copco can lower variable costs and reduce working capital (short-term tied-up capital). When the economic environment improves, management can quickly shift up a gear again. Atlas Copco has already done this several times in the past. In addition, more than a third of sales are generated with recurring services and maintenance services - an impressive figure for an industrial company.

More than four per cent of Atlas Copco's total turnover is continuously invested in research and development to ensure the company's organic growth and market leadership. Continuous innovation is essential in industrial manufacturing processes. For example, Atlas Copco is supporting the transition to a world with lower CO2 emissions with new battery storage solutions for solar power plants.

The company follows a structured process for acquiring smaller companies, with 18 acquisitions in 2023 alone. Atlas Copco focuses on acquiring companies with a geographically dispersed customer base that are leaders in niche markets and already have a strong customer and partner base.

The company is not only known in Scandinavia for the rigour of its business model, but also for its corporate culture. There is no ‘ducking away’ or glossing over possibly below-average management performance: Atlas Copco places an emphasis on meeting targets and holding each manager accountable. The continuity at the top of the company shows that this culture is successful in the long term: Vagner Rego was only the thirteenth CEO to take office in May 2024 since the company was founded in 1873. The average tenure of a CEO is therefore 12 years, which is well above average in a very lively industry.

We are positive about the growth prospects for Atlas Copco. The company is aiming for average growth of 8% per year over the economic cycle. The growth trends of digitalisation, deglobalisation and the goal of a ‘low carbon society’ on the part of customers should ensure that these targets are achieved.

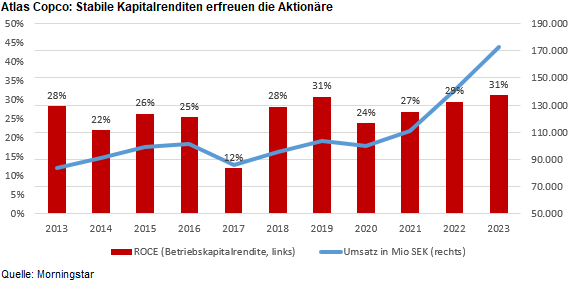

In addition to the quality of its management, the company is characterised by a strong focus on sustained high profitability. Atlas Copco aims for an average return on capital employed (ROCE) of 30 per cent. The ROCE can fluctuate depending on the company's annual acquisitions and investment opportunities, which shows that the management takes a measured and flexible approach and does not stay the course at all costs. In fact, according to our calculations, Atlas Copco has achieved an average ROCE of 28% with cash and 33% without cash over the last ten years.

Surplus liquidity is invested in share buy-backs and dividend payments. Shareholders can expect a payout ratio of 50% of the net profit for the year.

The fundamental risks for a long-term investment appear manageable in view of the efficient management. Demand for products for the semiconductor industry in particular is currently picking up again after a weaker previous year.

However, the current high valuation of the share can lead to short-term setbacks at any time, especially in the event of an economic downturn. Atlas Copco's share price losses are then usually significant, as some investors seem not prepared to endure these setbacks.

Author: Christian Kahler

The contents of this page are marketing communications and not financial analyses. It does not constitute investment advice or an investment recommendation, nor does it constitute an offer or a recommendation or invitation to make an offer to buy or sell the financial products mentioned. Insofar as we have presented performance and/or sample calculations in the aforementioned information, these do not allow any reliable conclusions to be drawn about future performance. References to past performance do not necessarily guarantee positive developments in the future, and reference is also made to the risk associated with transactions in financial products. The information mentioned reflects the author's judgement at the time of publication. The company discussed may or may not be part of the portfolio of our equity fund. Any investment decision should always be based on an individual analysis of the personal financial situation and risk tolerance.