Oktober 2025

In the flow of billions – Brookfield's transformation into a global investment giant

Brookfield's assets under management recently surpassed the trillion mark. The group, which started out as a Brazilian electricity supplier, now manages a huge amount of fixed assets. CEO Bruce Flatt is focusing on staying power, diversification into various tangible assets – from real estate and infrastructure to renewable energies – and a keen sense for megatrends such as the energy transition and digitalization. The simplified corporate structure of the Canadian company brings new discipline.

CEO Bruce Flatt as the key figure

Brookfield looks back on over a century of history, dating back to 1899. At that time, Canadian entrepreneurs founded the company “Brazilian Traction, Light and Power” in São Paulo to supply the Brazilian metropolis with electricity and trams. The company, which later became known as “Brascan” – a portmanteau of Brazil and Canada – developed over the following decades from a local energy supplier into a diversified conglomerate.

The company underwent a fundamental transformation in the 2000s. Brascan became today's Brookfield Corporation (ticker: BN), and its focus shifted to becoming a global asset manager for real assets. Under its new name, the company built its business model on acquiring, developing, and holding real assets worldwide for the long term. Under CEO Bruce Flatt, Brookfield cultivated a philosophy strongly reminiscent of value investing: patience, opportunism, long-term perspective. It often buys during crises (e.g., after the dot-com bubble, the financial crisis, the COVID period) when others are selling. This discipline sets Brookfield apart from yield-driven competitors who go along with cyclical overvaluations.

Capital with substance: How Brookfield makes money today

Today, Brookfield is a leading owner and manager of real estate, infrastructure, renewable energy assets, and other real assets with a clear focus on long-term value appreciation. These include commercial real estate, infrastructure such as utility and transportation networks, renewable energy facilities, private equity investments in companies, and insurance capital. The business model rests on two pillars: On the one hand, Brookfield invests significant proprietary capital in these real assets; on the other hand, the company manages the capital of institutional investors, such as pension funds, sovereign wealth funds, and insurance companies, through funds and investment companies. This combination of its own capital and the management of investor funds enables Brookfield to generate stable fee income and profit sharing, while at the same time participating in the long-term value growth of these investments.

Brookfield's success is characterized by a disciplined, long-term investment culture, embodied by its long-standing CEO Bruce Flatt. The management is known worldwide for opportunistically seeking out undervalued or neglected assets and investing countercyclically. Instead of chasing quick profits, Brookfield focuses on the patient development of its investments and consistent capital allocation. This calm, substance-oriented approach has earned the company the trust of large institutional investors.

Size comes at a price: complexity and risks

The downside of Brookfield's growth is considerable structural complexity. The group operates as a diversified holding company with numerous investments. Some business areas have been spun off into independent, publicly traded subsidiaries, such as Brookfield Infrastructure Partners (BIP) for infrastructure investments and Brookfield Renewable Partners (BEP) for renewable energies. In 2022, Brookfield also spun off part of its asset management business and listed it on the stock exchange under the name Brookfield Asset Management (BAM). Brookfield Corporation (BN) continues to hold its own capital and controlling interests. This structural improvement has made the company even more attractive to long-term investors.

Global trends as growth drivers

Immense investments in the expansion and modernization of infrastructure are needed worldwide, which plays into Brookfield's hands. The energy transition and advancing digitalization require enormous expenditures: on the one hand, the expansion of renewable power plants and electricity grids must be driven forward, and on the other hand, a massive expansion of data centers, fiber optic cables, and communication networks is necessary. Many countries cannot meet this investment need on their own and are therefore increasingly open to cooperation with private investors. Institutional investors – from pension funds to foundations – are also expanding their exposure to alternative asset classes such as infrastructure, real estate, and private equity in order to achieve stable long-term returns and diversification.

Due to its size and experience, Brookfield is in a privileged position to benefit from these trends. As one of the world's largest players in the real asset investment sector, the company has access to extensive capital—both its own and that of its institutional co-investors—and can participate in large-scale projects that would overwhelm smaller market participants. Decades of expertise in operating and optimizing infrastructure, real estate, and energy projects also enable Brookfield to manage such assets efficiently and exploit their value potential. This combination of financial strength, operational know-how, and global presence gives Brookfield a clear advantage when it comes to leveraging the global infrastructure boom and the energy transition as growth opportunities.

Our view as a long-term investor

From our investment firm's perspective, Brookfield Corporation remains an attractive long-term investment despite its complexity. The decisive factors are the quality of the assets and the prudent allocation of capital. The company invests in tangible assets with reliable cash flows and long-term substance—such as power grids, office properties, and wind farms—that retain their intrinsic value over decades. The management team led by Bruce Flatt waits patiently for the right opportunities and then acts decisively, rather than chasing short-term trends. This combination of high-quality assets, conservative financial management, and a steady-handed leadership culture forms the foundation for Brookfield's long-term appeal.

In addition, Brookfield is constantly opening up new areas of investment. For example, the company is currently involved in expanding the infrastructure for artificial intelligence, such as building large-scale data centers and data infrastructures.

Such future-oriented areas offer additional growth potential, as they require enormous amounts of capital and Brookfield is building up expertise at an early stage. Finally, macroeconomic trends could also have a positive effect: if interest rates were to fall again in the long term, this would raise the valuation levels for real estate, infrastructure, and other real assets, thereby strengthening Brookfield's asset values and fee income.

We are keeping an eye on these risks and weighing them against opportunities. Thanks to its global diversification, solid balance sheet, and strong partners, Brookfield is well equipped to weather even difficult phases. As we pursue a long-term investment horizon and seek to benefit from major structural trends such as the infrastructure boom and the energy transition, we view Brookfield as a globally experienced and fundamentally strong player. The company is likely to continue creating sustainable value in the future.

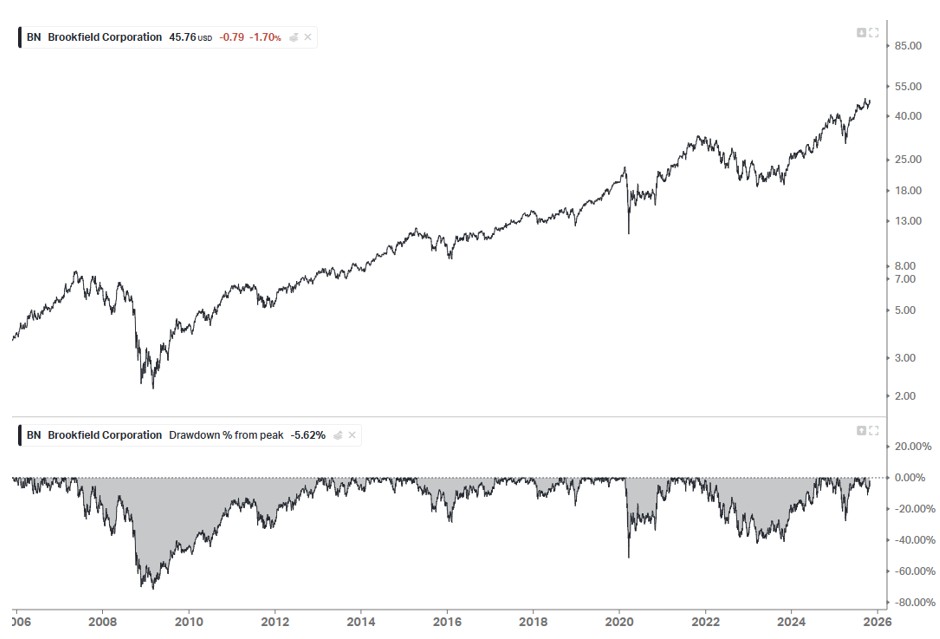

Share price performance (in USD)

Quelle: Koyfin

Author: Christian Kahler

The contents of this page are marketing communications and not financial analyses. It does not constitute investment advice or an investment recommendation, nor does it constitute an offer or a recommendation or invitation to make an offer to buy or sell the financial products mentioned. Insofar as we have presented performance and/or sample calculations in the aforementioned information, these do not allow any reliable conclusions to be drawn about future performance. References to past performance do not necessarily guarantee positive developments in the future, and reference is also made to the risk associated with transactions in financial products. The information mentioned reflects the author's judgement at the time of publication. The company discussed may or may not be part of the portfolio of our equity fund. Any investment decision should always be based on an individual analysis of the personal financial situation and risk tolerance.