February 2024

Deckers Brands: On thick soles to success

The success story of Deckers Brands is based on the success of the large, colourful HOKA running shoes and the fluffy luxury shoes from UGG. In addition to the high quality, the unusual design of the products, which also strikes a chord with many younger customers, is crucial to the company's success. The company seems not on everybody’ radar screen.

The origins of the successful HOKA brand

The history of HOKA running shoes is young and it began like Joseph Campbell's hero's journey: In 2009, Salomon trail running managers Jean-Luc Dicard and Nicolas Mermoud, who had met at a ski race in the French Alps, founded a joint company. The shoe market was huge, but the shoe manufacturing technology was relatively simple. Their original concept was to imitate the feeling of riding a wave on a surfboard or skiing down a mountain.

This feeling was previously unknown to trail runners, as almost every step on uneven terrain became torture after a few kilometres in the usual running shoes of the time. After a long period of tinkering with shoes that could be used to run faster downhill, it became clear: as with bicycle tyres or ski boards, the innovation lay in a simple formula: The bigger, the better. The HOKA ONE ONE brand models were accordingly thick and wide. HOKA ONE ONE, a term for the Maori language roughly translates to "fly over the earth".

While ‘the HOKAs’ were proud of their pronounced maximalism, the trade press and managers of other running shoe brands labelled the HOKAs as ‘marshmallow’ or ‘clown’ shoes: inflated, thick, extreme, ugly - and from France to boot. The market was in ‘natural running’ fever at the time, and shoes with thin, flexible soles like the Nike Free were all the rage. The motto among runners was: the less material underfoot, the better.

Nicolas Mermoud travelled to a trade fair in the USA in 2009 with a bag full of prototypes and no exhibition stand. These first shoes had so little in common with the competition that almost everyone who raved about them remembered their first encounter with them. In 2010, HOKA only delivered 1,100 pairs of shoes to the USA and Canada, but the shoes immediately became bestsellers with professional trail runners.

Takeover of HOKA by Deckers Brands

The managers of the American company Deckers Brands (formerly Deckers Outdoor, founded in 1973, stock market symbol: DECK, USD 17 billion market value), some of whom were professional runners themselves, became aware of HOKA and recognised the benefits for runners.

Deckers Brands owns the brands UGG (lambskin boots) and Teva (sandals). The UGG brand had already been bought as a start-up by an Australian surfer in the mid-1990s and successfully developed into a global brand. Deckers initially acquired a stake in HOKA at the beginning of 2012.

The complete takeover took place in September 2012 at a price estimated by industry insiders of USD 1.1 million. In the annual report, Deckers categorised the takeover as ‘insignificant’, which is likely to go down as one of the biggest understatements in the history of the US stock market.

Further development of HOKA into an international brand

Under the leadership of Jim Van Dine's extended management team, HOKA was continuously developed over the following years. Despite their solid soles, the shoes became lighter and more flexible, offering better protection against injuries. The colours of the shoes became more eye-catching. The mixture of shoe size and colour design could almost be described as cartoonish. However, it is one of the main reasons for the shoes' popularity with young buyers.

The unlikely billion-dollar market started with word of mouth in the niche but influential running scene. Nike, Brooks and Asics lost ground in the running market, so fresh brands like HOKA and the Swiss company On Lücken emerged. The business also benefited from pandemic tailwinds such as home office and casual office work, as more and more people discovered that running shoes also worked as everyday shoes on the street or at work.

Crucial to its commercial success is that HOKA's management has managed to maintain scarcity and thus protect the brand. The shoes are not sold in the large non-food retail chains, and sales via established shoe retailers such as Footlocker and sneaker chains such as JD.com only began after the brand had achieved a very high level of recognition. Careful distribution, combined with a high proportion of shoes sold directly to consumers, makes it possible to control selling prices (usually over 150 euros per pair) and achieve high profit margins.

At the same time, HOKA cultivates its heritage and is present in the right places and in front of the right people. This was evident at the last Frankfurt Marathon, for example, where HOKA was the main sponsor and - in our opinion - offered by far the best service of all the suppliers at the event. HOKA also sponsors the biggest events on the scene, such as the Ultra Trail du Monc Blanc (UTMB) and the Ironman.

Booming sales and profits at Deckers Brands thanks to HOKA and UGG

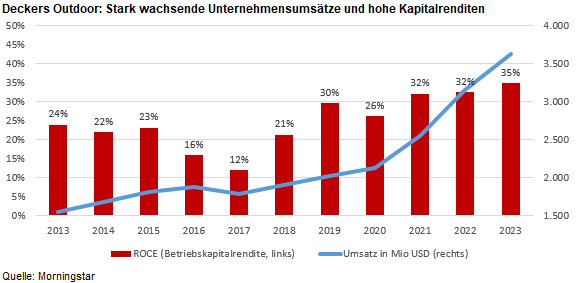

The acquisition of HOKA has paid off for Deckers Brands. The turnover of the entire group has increased by 10% annually over the last ten years, from USD 1.4 billion to USD 3.6 billion in 2023. In the last three years, growth has almost doubled thanks to the pandemic and the expansion of the HOKA running shoe brand into apparel. In the last quarter, Group sales even jumped by 27% and reached the billion mark per quarter for the first time. For 2024, the management is forecasting sales of over 4 billion US dollars.

Despite the success of HOKA shoes, it should not be forgotten that the UGG brand with its boots is still the biggest sales driver at Deckers and contributes almost half of sales. The fluffy luxury shoes made of lambskin, which are reminiscent of slippers, polarise consumers just as much as HOKA shoes. Many well-known faces such as Rihanna, Bella Hadid and Kendal Jenner have made the brand famous, and thanks to the large fan base on social channels, sales have recently grown faster than HOKA.

Margin mix and low capital employed lead to high profitability

Deckers Brands operates very profitably thanks to high margins and low capital commitment in the company. The Group's return on capital employed in 2023 is 36% (69% without cash). These above-average figures compared to the industry as a whole are mainly due to a combination of pricing power, strong direct business with end customers (bypassing the retail trade) and low capital intensity thanks to largely outsourced production. Thanks to surplus free cash inflows, a quarter of the outstanding shares have been bought back since 2015.

Sector risks and outlook

In addition to logistics, one of the biggest risks for Deckers Brands is that brand management does not deliver on focus and innovation.

Phil Knight, the founder of Nike, built his success on the fast-moving trends in the industry and put companies such as Converse and Adidas under massive pressure in the early years of the company, particularly in basketball. With HOKA, Deckers is now pursuing a similar outsider strategy as Nike did back then, but in the running shoe sector.

The company wants to establish itself even more internationally with its own stores and also in the clothing sector. The brand currently seems to have enormous tailwind, thanks to successful social media campaigns and the appeal of the products among young customers. And there is still plenty of potential for HOKA to take market share from the seemingly overpowering companies such as Asics, Adidas and Nike. Added to this is UGG, which remains the most important Group brand and recently recorded the strongest growth within the Group.

Quality and management focus

Continuity in the management of the Group is therefore the order of the day. With the current transition from CEO David Powers, who has been in office since 2012 and is now moving to the Supervisory Board, to his successor Stefano Caroti, who stands for the great successes of the past in the omnichannel area of all the Group's brands, we believe this continuity is guaranteed.

Despite its strong growth, Deckers Brands is still a little-known company. Management keeps a low profile and, for example, does not attend investor conferences organised by the major Wall Street banks. We appreciate the down-to-earth-attitude of Decker’s management team.

Positioning in the fund

For stock pickers like us, it is an advantage that companies like Deckers are little known to the public. In our analysis, we have conducted our own research and also engaged in discussions with representatives of the company. We are invested in Deckers Brands since the beginning of 2023.

Author: Christian Kahler

The contents of this page are marketing communications and not financial analyses. It does not constitute investment advice or an investment recommendation, nor does it constitute an offer or a recommendation or invitation to make an offer to buy or sell the financial products mentioned. Insofar as we have presented performance and/or sample calculations in the aforementioned information, these do not allow any reliable conclusions to be drawn about future performance. References to past performance do not necessarily guarantee positive developments in the future, and reference is also made to the risk associated with transactions in financial products. The information mentioned reflects the author's judgement at the time of publication. The company discussed may or may not be part of the portfolio of our equity fund. Any investment decision should always be based on an individual analysis of the personal financial situation and risk tolerance.