September 2024

HEICO: Quality and integrity as a recipe for success in a niche market

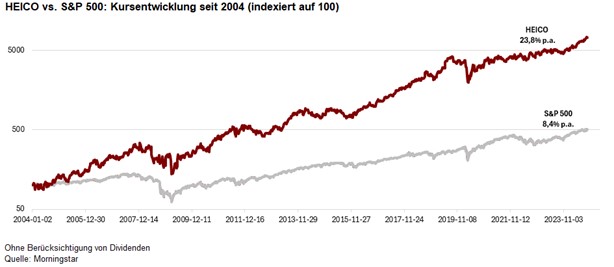

HEICO Corporation has established itself as a leading independent supplier in the aerospace industry since the 1990s. Its unique business model and good growth prospects have made HEICO a core holding since the fund was launched in 2022. Warren Buffett also recently became a shareholder.

History of an inconspicuous market leader

Despite the recent entry of Berkshire Hathaway, the American HEICO Corporation is one of the companies that flies under the radar screen of most investors. The Florida-based company is the largest independent manufacturer of engine parts and components for the aerospace industry. The focus is on the production of parts that are usually not sold by major aircraft and engine manufacturers and on products with attractive margins. In the past, these were simple fastening parts such as nuts or screws; today, the product portfolio includes highly complex electronic assemblies such as emergency transmitters. Since the early 1990s, HEICO has sold more than 100 million parts. The company also offers repair and maintenance services.

Strategic realignment under the Mendelson family

HEICO has existed for over 65 years, but the decisive turning point in the company's direction came in 1990. In that year, the Mendelson family took control of the company. The Mendelsons had recognised that HEICO had a special business model on paper with very high barriers to entry and began to increasingly align it with their own ideas.

Profitable business model with high entry barriers

The reason for this is simple. Every part that is sold in the aviation industry must first be approved by the American aviation authority FAA. Since these parts are generally not patent-protected, they could be inexpensively reproduced by HEICO or acquired suppliers and approved by the FAA.

The Mendelsons realised that this could be a lucrative business model if they could obtain approval faster and sell more cheaply than their competitors (economies of scale), as the barrier to entry for FAA approval is very high. The FAA is considered to be very strict and bureaucratic, and in the early 1990s only a few parts were initially certified each year. The safety of the aircraft in operation was the top priority, and potential risks from listing new suppliers were avoided.

Breakthrough after Lufthansa's entry in 1997

A turning point for HEICO was the entry of Lufthansa Technik AG as a shareholder in 1997 with a 20 per cent stake. The entry of the reliable Germans signalled to airlines that HEICO's parts were trustworthy and could be purchased. In any case, they were interested in cost-effective sources of supply from a single source and not in expensive products from original parts manufacturers such as Boeing, Airbus, Rolly Royce, GE Aviation and others.

In addition to Lufthansa, the Mendelson family, the management and the legendary investor are the Mendelson family, the management and the legendary investor Dr. Herbert Wertheim.

Planned acquisitions strengthen growth

In the following years, numerous smaller companies that were already selling FAA-certified parts were acquired. Management pursued a structured M&A process which helped integrating acquired companies quickly into the holding company and limited the risk of paying excessive prices. Since the Mendelsons joined the company in 1990, over 90 companies have been acquired.

Two strong divisions drive the company forward

In addition to the ‘Flight Support Group’ division (approx. 50% of sales), which develops spare parts for engines and aircraft components and offers maintenance and repair services, the ‘Electronic Technologies Group’ division develops and produces various electronic and electro-optical products, including underwater detection devices, electromagnetic and radio frequency shielding and much more.

HEICO currently has over 5,000 FAA-approved products and can register 400 to 500 additional products for approval each year. HEICO supplies 19 of the 20 largest airlines and leading defence companies. Since 1990, the company's sales have increased by an average of 15% per year and net profits by 18% per year.

Long-term success through partnership-based thinking and fair pricing strategies

Most successful companies with long-term visions have one trait in common:

They create win-win situations for everyone involved. In particular, it is about creating the greatest possible value for the customer. This is also the recipe for success of companies such as Costco and Amazon.

HEICO's management has made it clear in its pricing strategy that it is not out to maximise profits and, despite cost leadership, rarely sells products with a profit margin of more than 20 percent. The Mendelssohns do not want to give the impression that they are making an excessive amount of money with their airlines and want to keep the business going with their customers, some of whom have been with the company for 30 years.

The fact that cost savings are passed on to customers is similar to the business model of US retailer Costco. This special feature of HEICO's business model is also likely to be a decisive reason for Berkshire Hathaway's investment.

HEICO's competitors such as Transdigm, on the other hand, are pursuing a more aggressive style. They are also trying to acquire the patents required for the products and thus narrow the market for certain aircraft parts.

Corporate culture as a success factor

As HEICO pursues a more sustainable approach by passing on savings to its customers and producing high-quality parts, it is difficult to imagine that its competitors will be able to catch up in the medium term. HEICO's corporate culture also has other special features, which are set out in the Code of Conduct. These include entrepreneurial thinking at employee level, the highest standards in dealing with employees, customers and suppliers and responsibility towards society. Regular employee surveys and the high level of employee participation in the company's shares via pension schemes show that this is not just lip service.

Crisis management, growth opportunities and risks

HEICO has also successfully mastered the difficult market environment following the Covid-19 years thanks to its service division. Increased competition remains a risk, as many of the products are not patent-protected (but have FAA approval). However, with the acquisition of the Wencor Group last year, one of the largest competitors with a portfolio of over 6,000 FAA-approved parts was taken over. The company, in which we have been invested since the launch of the fund in August 2022, is now looking for new growth opportunities.

Future drivers: sustainability and space programmes

There is no shortage of potential organic sales drivers. On the one hand, the company could expand its existing business through growth and acquisitions. For example, an aircraft consists of up to two million individual parts, of which HEICO can currently supply ‘only’ 12,000 or 0.6%.

In addition, CO2 emissions in aviation are set to be reduced to zero by 2050. This leads to the expectation that the business with more efficient spare parts and new technological solutions in existing aircraft fleets should flourish.

Another driver is the sharp rise in demand from space programmes such as NASA's Artemis moon mission and private initiatives. Experts predict that the global market volume for space travel will double to USD 1 trillion by 2040. Based on these forecasts and the company's special positioning, the outlook for HEICO remains positive.

Author: Christian Kahler

The contents of this page are marketing communications and not financial analyses. It does not constitute investment advice or an investment recommendation, nor does it constitute an offer or a recommendation or invitation to make an offer to buy or sell the financial products mentioned. Insofar as we have presented performance and/or sample calculations in the aforementioned information, these do not allow any reliable conclusions to be drawn about future performance. References to past performance do not necessarily guarantee positive developments in the future, and reference is also made to the risk associated with transactions in financial products. The information mentioned reflects the author's judgement at the time of publication. The company discussed may or may not be part of the portfolio of our equity fund. Any investment decision should always be based on an individual analysis of the personal financial situation and risk tolerance.