July 2023

Unilever - Is the glass half full ?

Unilever can look back to an impressive success story. In recent years, however, operational development stagnated. Under the leadership of the new CEO Hein Schumacher, an era of change and accelerated growth could be around the corner. The company’s risk/reward profile looks attractive.

Stagnation in operational development: a critical analysis of recent years

The Unilever Group is an international consumer goods giant with an impressive portfolio of brands in the food, beverages, cleaning products and personal care. Unilever was formed in 1930 as a merger of the Dutch margarine company Margarine Unie and the British soap manufacturer Lever Brothers and has since continuously expanded its portfolio to over 400 brands: Dove, Knorr, Lipton, Magnum, Rexona, Omo and many others, which are used daily by millions of consumers around the world. The company focuses on five business areas and sells its products in 190 countries. Unilever’s 14 top brands generate sales of at least one billion euros each. Due to its history, Unilever has a strong position in the emerging markets. The Indian subsidiary Hindustan, for example, was an important value driver for the Group in the 2000s.

The long road to change: challenges and opportunities for Unilever

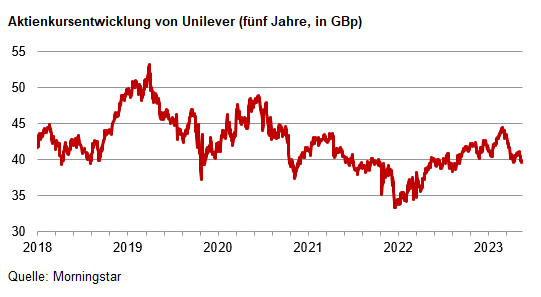

At first glance, it seems as if one of the world's largest manufacturers of consumer goods should keep its shareholders happy due to the popularity of its branded products and its pricing power. However, a closer look at Unilever's annual reports shows that the company has fallen short of its potential in terms of both margin and sales growth over the last four years. The share price has also moved sideways over the last 5 years - see chart.

While the Group's operating margin fell from around 19% to 16% between 2019 and 2022, the return on capital employed decreased from 19.2% to 16% over the same period. The declining operating margin is one of the reasons why Unilever shares traded at a significant discount to competitors such as Colgate-Palmolive, Nestle or Procter & Gamble. The declining returns on capital employed indicate that there is room for a better capital allocation. In addition, failed acquisition plans such as the attempt to take over the consumer business of GlaxoSmithKline (GSK) and Pfizer for USD 68bn have damaged management's reputation.

CEO Hein Schumacher - A new beacon of hope?

Hein Schumacher’ appointment as CEO of Unilever has increased the likelihood for positive change: During his tenure as CEO of FrieslandCampina, Schumacher introduced far-reaching changes to both organisation and management in order to strengthen the competitiveness of the Dutch company. He also embedded the organisational changes into the new strategy ‘our purpose, our plan’. As a result, ambitious targets for organic growth, gross margin and return on investment resulted not only into a new strategic direction but also channelled resources into the right areas. Under his leadership, FrieslandCampina's operating margin rose from 3% to 3.3% within four years.

Potential for increasing margins thanks to reorganisation and reduction in complexity

In our opinion, Unilever's management should focus on reducing complexity following the change of CEO. After all, it is questionable whether Unilever really needs 400 brands to realise its entrepreneurial potential. A focus on streamlining workflows and processes should lead to more efficiently and better operating margins in the medium term. M&A transactions do not appear necessary for the time being. In our view, Unilever has the potential to achieve an operating margin of over 20% in the medium term. According to press reports, further changes to the Management Board and Supervisory Board seem in the pipeline. We see this as a positive, as top managers who join from the outside sometimes look at old problems from a new perspective.

Patience is the key: Unilever as a long-term investment with attractive returns

If management succeeds in increasing organic sales growth to 4-5% p.a. and in raising operating margins to over 20%, the positive changes will not go unnoticed. As a result, a re-rating of Unilever’s shares could follow. We are very much aware though, that a patient attitude is needed as changing habits and structures sometimes takes much longer than expected.

However, already today, Unilever looks attractive to us with an expected dividend yield of 3.8% and a free cash flow yield of 6.7% for 2024. We are confident that Mr Schumacher's experience and track record will enable him to meet and perhaps even exceed the expectations of Unilever shareholders.

Author: Jochen Kurz

The contents of this page are marketing communications and not financial analyses. It does not constitute investment advice or an investment recommendation, nor does it constitute an offer or a recommendation or invitation to make an offer to buy or sell the financial products mentioned. Insofar as we have presented performance and/or sample calculations in the aforementioned information, these do not allow any reliable conclusions to be drawn about future performance. References to past performance do not necessarily guarantee positive developments in the future, and reference is also made to the risk associated with transactions in financial products. The information mentioned reflects the author's judgement at the time of publication. The company discussed may or may not be part of the portfolio of our equity fund. Any investment decision should always be based on an individual analysis of the personal financial situation and risk tolerance.